Building the rails for collaborative identity with Connect

As financial ecosystems have become more connected, one challenge has remained: Every company still manages its own KYC process.

When I worked in payments, I saw this firsthand. Everyone agreed KYC was essential, but few found it efficient. Each new partner or product meant another round of verification, often for the same users and the same data.

Across the industry, 25–35% of users abandon onboarding when asked to upload an ID and selfie. They’re not unwilling to verify, but they drop off because they’ve already done it. Reverification repetition creates friction for users, adds cost for organizations, and does little to strengthen compliance.

Shareable KYC changes that. Once a user’s identity has been verified, that information can be securely reused across trusted organizations. It’s a simple idea with a big impact — and it’s what led us to build Persona Connect.

Introducing Persona Connect: infrastructure for shareable KYC

Persona Connect is a new way for organizations to securely share and reuse verified identity data while staying compliant and keeping users moving forward. We developed Connect hand in hand with the leading infrastructure companies that power the broader fintech and crypto ecosystem, including Coinflow, BitGo, and others.

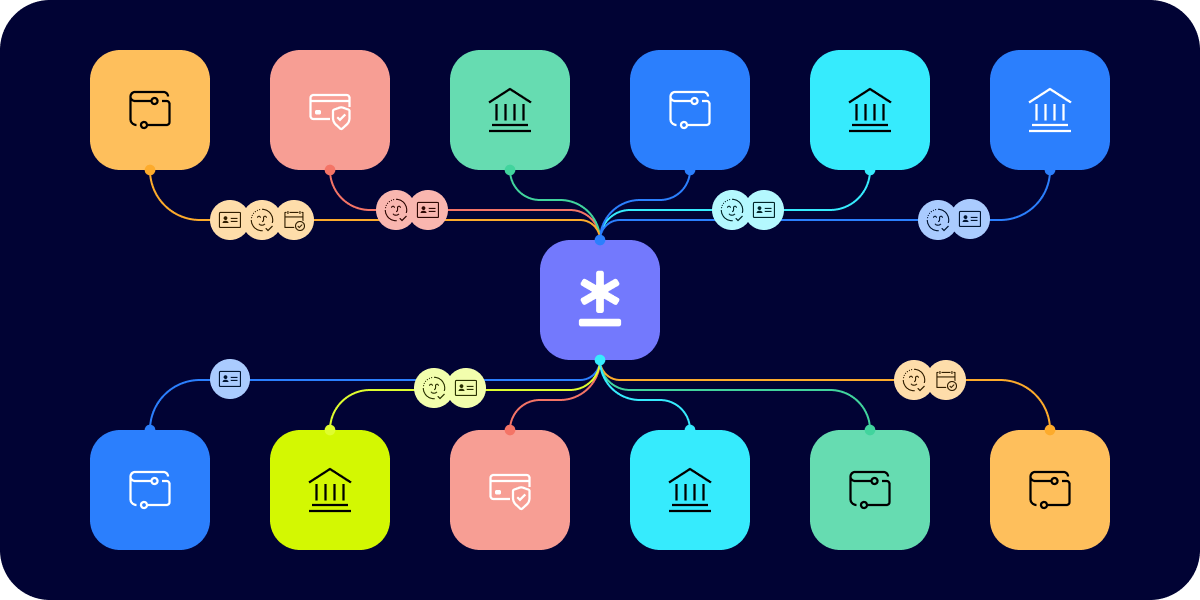

With Connect, trusted partners can build their own secure, consent-driven networks for sharing verified KYC and KYB data — whether between crypto partners, across marketplaces, or between crypto and traditional finance. Each organization can design and operate its own data-sharing network tailored to its needs.

Unlike other solutions, Connect isn’t a rigid global consortium. Instead, it’s an entirely new approach to collaborative identity. Let’s walk through how it works.

Faster onboarding and reduced drop-off

For many users, onboarding is the moment they decide whether to stay or drop off. KYC is essential at this stage, but it also adds friction. Every extra upload, additional screen, or repeated step slows users down.

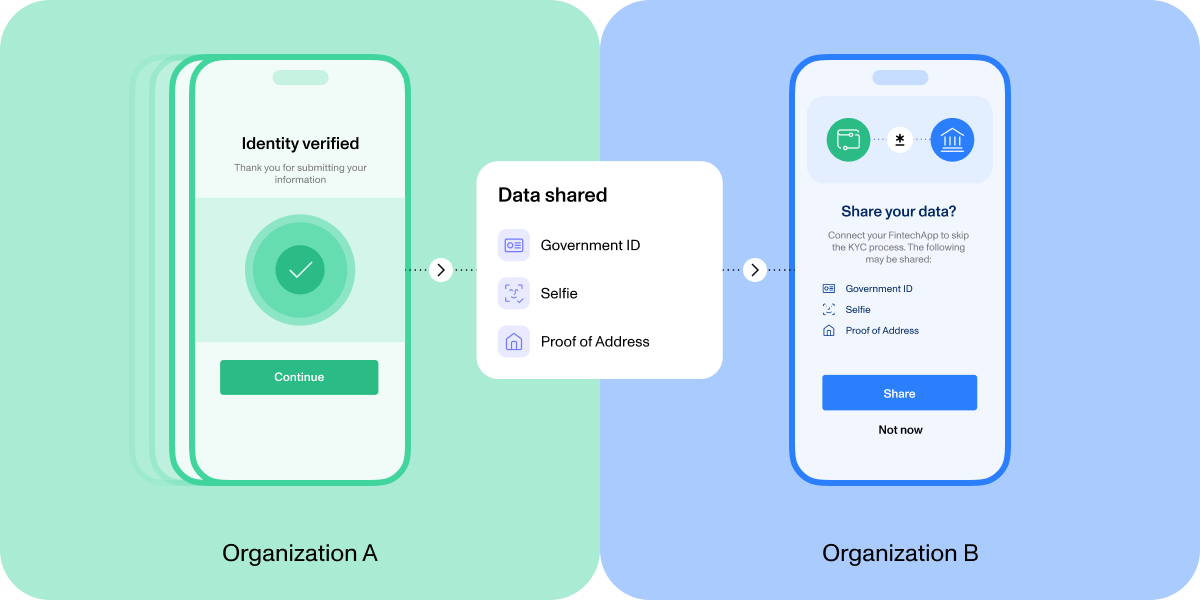

Connect helps reduce friction by allowing organizations to reuse verified information instead of collecting it again. Here’s how it works:

Connect prefills or securely copies what has already been verified. By removing unnecessary steps and repetitive screens, Connect creates a shorter, smoother experience that still meets every compliance requirement.

Partners control how they use shared verification data. A partner can copy full verification results (including supporting documents and outcomes) from a trusted organization for review or storage. If their policy requires it, they can re-run a verification using shared data to meet their own risk and compliance standards.

For example, let’s say that a user has already verified with one partner. When the user signs up with another, Connect can prefill their government ID and selfie information and approve it with one tap.

This consent-based flow replaces multiple ID upload screens with a single approval, saving time and reducing drop-off. All of these sharing options fit seamlessly into existing Persona flows, helping teams deliver onboarding experiences that are faster, simpler, and fully compliant.

Compliance made easier with standardized verification sharing

Staying compliant while sharing verified information has never been simple. That’s because every organization has its own requirements, agreements, and technical setup for what can be shared and how.

Connect removes that complexity with a consistent, secure way to exchange verified information while meeting regulatory standards.

Every organization controls who they share data with, what’s shared, and how it’s exchanged:

Share Tokens for secure data sharing. Connect uses Share Tokens to let organizations share verified identity or business information without exposing personal information. Share tokens are secure credentials backed by user consent with encrypted data that can only be accessed by specific organizations.

Full control over data. In each exchange, one organization acts as the source that securely shares verified data. The other acts as the destination, reviewing or importing the results. Both maintain full control, and every step is logged for transparency and auditability.

Each Share Token includes the same level of detail as a full Persona verification, including identity data, document images, and verification outcomes. For instance, a payments provider can receive another organization’s verification results to support AML recordkeeping or internal review. If a compliance process requires additional screening (such as watchlist checks or reverification), Connect will automatically trigger that step once a Share Token is redeemed.

Connect supports FinCEN’s reliance provision under CIP by giving institutions a secure, consent-driven way to share verified customer and business information that meets AML requirements. Every exchange makes it clear who owns the data, safeguards sensitive details, and creates a complete audit trail, so compliance teams can work together seamlessly without losing visibility or control.

Lowered costs from eliminating duplicative KYC

It’s challenging to keep KYC efficient as you grow. If your teams want to share verified data, the process typically involves new integrations and tri-party agreements that require significant time and maintenance.

With Connect, building your sharing ecosystem is easy. You can create secure connections directly in the Persona Dashboard with no engineering resources or custom setup. Connect works wherever teams already use Persona — in the Dashboard, through workflows, or via API — so it fits naturally into existing operations.

For example, a B2B2C fintech company can use Connect to both share and receive verified identity results with multiple partners through one secure setup. As new partners are added, it can create additional connections in minutes.

Instead of losing months to building separate integrations for each,the company can scale quickly without added infrastructure or complexity. By reusing verified information, both the fintech company and its partners can cut vendor costs, reduce engineering effort, and keep KYC operations efficient as they grow.

Building the future of collaborative identity

Connect is more than a product. We’re excited about what Connect unlocks: A more connected and efficient approach to identity, where organizations work together on trust rather than repeating the same checks in isolation.

When verified information moves securely between trusted partners, onboarding gets faster, compliance gets stronger, and collaboration gets easier across entire ecosystems. This is what we call collaborative identity, in which verified data moves safely between trusted organizations to reduce friction and improve user experiences.

As more companies adopt Connect, each new participant strengthens the ecosystem. (Reusable Personas, our user-owned identity product, complements Connect by giving individuals the same ability to share their verified information with the organizations they choose.)

If you’re already a Persona customer, reach out to your account team to learn how to participate. If you’re new to Persona, book a demo or try it now to see Connect in action. We’ll also be showcasing Persona Connect at Money20/20 in Las Vegas (Oct 27–30, 2025). Visit us at booth #16106 to see it in action and learn how you can help build the future of collaborative identity.